Summary

Generationally high inflation has led to the most rapid monetary tightening in recent history. The impact of this on regional economies may vary wildly, in large part due to different growth outcomes. The U.S. economy in particular has proven to be far more resilient than anyone could have expected despite the Federal Reserve’s efforts to rein in inflation. The resulting Goldilocks outcome of strong growth and lower inflation was achieved by a timely expansion in the supply side of the economy, driven by better-than-expected gains in the workforce and productivity. Vanguard’s economic forecast anticipates stronger growth, a sturdy labour market, stubborn inflation, and a U.S. Federal Reserve that will move cautiously toward its first rate cut—including the possibility of no interest rate cuts this year.

Vanguard expects growth in the Euro area and UK to be below trend as productivity has waned and policy has been more restrictive. The Chinese economy has also faced headwinds, particularly from demand-side factors such as retail sales, despite showing early signs of momentum toward what is likely to be an uneven recovery. We feel it will be difficult for China to reach its economic growth target of “around 5%” for 2024. For broad emerging markets, we expect growth of around 4%, given several emerging market regions may benefit from earlier rate cuts.

We no longer expect a recession in Canada this year, given stronger momentum in late-2023 after upward revisions to growth data and stronger activity in the U.S. However, we still expect growth to remain below trend as the Canadian economy is far more interest-rate sensitive than the U.S., given high household debt-to-income ratios and relatively shorter mortgage terms. This below trend pace of growth is expected to contribute to further moderation in inflation pressures, and we see the Bank of Canada reducing rates by 50-75 bps this year.

Canada

Growth & Output

Canada’s GDP grew by 1% in the fourth quarter of 2023, yet GDP per capita has fallen in five out of the last six quarters. Recession risks have receded in Canada for this year, as consumer spending has been supported by record immigration and stronger U.S. activity. However, we foresee below trend 2024 GDP growth of 1.25-1.5% with risks to the downside, as higher interest rates start to bite.

Canada’s productivity growth was classified as an “emergency” by senior deputy governor, Carolyn Rogers. Productivity rates have fallen for six consecutive quarters, primary driven by lack of business investment in areas such as equipment, machinery, and intellectual property. Lack of competition across various industries, such as telecommunication and banking, is not incentivizing companies to invest as their high profit margins and industry dominance provide less incentive for operational efficiency.

Our proprietary Vanguard Leading Economic index (VLEI) points to moderate growth in Q1 2024 (Fig 1). However, we continue to expect that growth will remain below potential in upcoming quarters.

The Bank of Canada projects GDP growth to be 1.5% in 2024 and 2.2 % in 2025. Our expected projection for GDP growth in 2024 is 1.25-1.5 per cent.

Vanguard’s proprietary index of leading economic indicators (VLEI) provides insights into various types of economic activity (positive or negative). In short, VLEI provides a forward-looking view on the economy. Our current VLEI indications point to an improvement in activity in Q1, which can be seen in the chart below.

Figure 1: Vanguard's Leading Economic indicators (VLEI) point to an improved activity in Q1, 2024

Employment

Canada’s labour market is showing signs of softening, with the unemployment rate rising to 6.1% as of March 2024, up from 5.1% a year ago, as employment growth lags that of the working age population, with the public sector driving a significant portion of job growth. Over the past year, employment in the public sector has grown 4.8 per cent, versus 1.1 per cent in private industry as of March 2024. Wage growth has shown some signs of moderating, and expected increases in labour supply due to immigration should help soften wages going forward.

Inflation

Headline inflation continues a slow progress towards target and was 2.8% YoY in February, a touch lower than a 2.86% gain in January.

Core inflation (ex-food and energy) has made some progress toward target in recent months, moving to 2.8% YoY in February, down from 3.1% in January.

Upside risks come from shelter inflation (particularly higher mortgage interest costs that remain elevated due to high interest rates, as well as rent and homeownership costs coming from insurance, taxes, and repairs).

Downside risks could come from continued softness in the price of goods.

We foresee core inflation falling to the 2%–2.5% range (year-over-year), within the BOC’s target range, by the end of 2024 as growth remains below trend and labor markets soften.

Figure 2: Canadian inflation has been declining since January, 2023

Interest Rates

The Bank of Canada (BOC) held its overnight lending rate at 5%, its highest level in 22 years, for a fifth consecutive meeting and signalled that no further hikes are on the horizon if the economy moves in line with its forecasts. Governor Tiff Macklem said that the data is moving in the right direction for potential future interest rate cuts. However, the statement noted that “inflation is still too high, and risks remain” but acknowledged the inflation progress towards the target in recent prints. The BoC wants to see “evidence that this downward momentum is sustained” in upcoming months.

We have adjusted our forecast for rate cuts down to potentially two or three cuts of 25 bps each for 2024.

Risks to the outlook:

Softer consumer spending. As higher interest rates work through the economy, consumers may need to allocate more financial resources to higher mortgage payments instead of purchasing goods and services leading to slower demand.

A persistent rise in energy prices could lead to additional inflationary disruption. While this would prove a positive catalyst for Canadian trade growth, its exasperation of inflationary tensions may put pressure on the economy through lower discretionary consumption and make it more difficult for the BOC to cut rates.

United States

The U.S. economy has proved resilient despite Federal Reserve efforts to cool things down to rein in inflation. Given the economy’s continued strength and stubborn inflation, Vanguard believes that the Fed may not be in position to cut rates at all in 2024.

A continuation of U.S. economic exceptionalism

Better-than-expected workforce and productivity gains are behind the U.S. economy’s continued vigor. A combination of productivity growth of 2.7% and the addition of 3.5 million people to the workforce more than offset the effects of Fed monetary policy tightening in 2023. Household balance sheets bolstered by pandemic-related fiscal policy and a virtuous cycle where job growth, wages, and consumption fuel one another provide additional support. Although 2023 growth exceeded expectations in many other developed markets, none rivaled the United States’ above-trend growth.

At its last meeting on March 20, the Fed left its federal funds rate target unchanged in a range of 5.25%–5.5%. The Fed increased its forecasts for real GDP growth and inflation. The economy expanded by 2.5% on an average annual inflation-adjusted basis in 2023, higher than the 1.9% increase registered in 2022. For 2024, we foresee growth of around 2%, higher than our initial growth estimate, in part because of the continued runway for consumer demand.

The U.S. consumer has remained surprisingly resilient, keeping the economy vibrant despite the Federal Reserve’s efforts to rein in inflation by keeping interest rates elevated. And runway remains for households to continue to drive strength in the economy, according to Vanguard’s research. A continued strong labor market, reasonable credit usage, and favorable wealth effects provide the backdrop for continued consumer health. Elevated wage growth, robust equity market gains, and increased savings have contributed to a wealthier, more stable consumer over the past few years, and higher home values have also had an impact.

The unemployment rate edged down to 3.8% in March, down from 3.9% in February, but in our view the labor market remains on solid footing. We expect that labor supply strength and job growth will continue for a good part of 2024 before gradually subsiding and the unemployment rate ending 2024 at around 4%.

Core inflation, as measured by the Personal Consumption Expenditures Price Index, edged down to 2.8% year over year in February from 2.9% in February. We continue to believe that the last mile to 2% inflation will remain challenging and that sticky services inflation will take time to unwind.

Rest of the world

Although the Euro area avoided falling into recession in the fourth quarter of 2023, we continue to expect 2024 growth in a below-trend range of 0.5%–1% amid still-restrictive monetary and fiscal policy and the lingering effects of Europe’s energy crisis on industry.

The ECB kept its key deposit facility rate on hold for 4% at its April 11 meeting. We foresee the European Central Bank (ECB) initiating a deposit facility rate-cutting cycle in June, with 25-basis-point cuts potentially at each of its final five 2024 policy meetings leading to a year-end range of 2.5%–3%. (A basis point is one-hundredth of a percentage point.)

Headline inflation moderated to 2.4% year over year in March, down from 2.6% in February. However, the monthly rate of inflation continued to rise, to 0.8% in March from 0.6% in February and 0.4% in January. An upside surprise to initial inflation data for February and March effectively ruled out an April start to rate cuts. However, the confluence of moderating wage growth, inflation expectations that remain in check, and lackluster demand supports our expectation for headline inflation to fall to 2% by September 2024 and core inflation to reach that target by December.

The labor market may be softer than the unemployment rate would suggest as job vacancy rates, though still high, have receded, labor hoarding remains elevated, and the number of hours worked has stagnated. We have downgraded our year-end 2024 unemployment rate forecast to 6.5%, the same number as its current level in February.

The U.K. economy fell into recession in late 2023, but a monthly estimate for growth in January and February suggested the recession could be short. GDP grew by 0.1% in February. That said, we have lowered our forecast for economic growth to 0.3% for full-year 2024. The Bank of England (BOE) held the bank rate steady at 5.25% for a fifth consecutive meeting in March as it waits for further evidence that inflationary pressures are subsiding before beginning to cut.

In our base case, we foresee a first policy rate cut in August, and a total of 100 basis points—or 1 percentage point—of cuts in 2024. Headline inflation slowed to 3.4% in February year over year, the smallest annual gain since September 2021. We foresee it falling to just below 2% by the end of 2024. The unemployment rate was 3.9% in the November–February period, marginally higher than in the preceding rolling three-month period. As in the euro area, the labor market’s gradual loosening appears mainly driven by soft factors such as reduced vacancies and fewer hours worked, rather than an increase in unemployment. As such we have lowered our year-end 2024 unemployment rate forecast to a range of 4%–4.5%.

We continue to see GDP growth around 4% for emerging markets in 2024, led by growth around 5% for emerging Asia. We anticipate growth in a range of 2%–2.5% for emerging Europe and Latin America, though our recent U.S. growth upgrade could signal positive implications for Mexico and all of Latin America.

The Chinese economy appeared to have made a solid start to 2024 showing early signs of momentum toward what is likely to be an uneven recovery. Although supply-side factors such as industrial production and fixed asset investment recently exceeded consensus estimates, demand-side factors such as retail sales fell short of expectations. Questions have also arisen about its ability to sustain its growth after the second quarter, when year-over-year comparisons will be relatively easy.

That supply-demand imbalance is just one factor that may make it difficult for China to reach its official economic growth target of “around 5%” for 2024. Other factors include persistent economic challenges stemming from an extended property downturn and base effects, or comparisons to year-earlier numbers, which will be higher this year.

Consumer prices broke a four-month string of annual declines in February, but we don’t believe that spells the end for China’s recent dip into deflation. Rather, we attribute the higher prices in February to easy year-earlier comparisons. Lunar New Year holidays occurred in February this year; in 2023, they occurred in January. To mitigate deflationary pressure, we expect the People’s Bank of China to ease its policy rate from 2.5% to 2.2% in 2024 and to cut banks’ reserve requirement ratios.

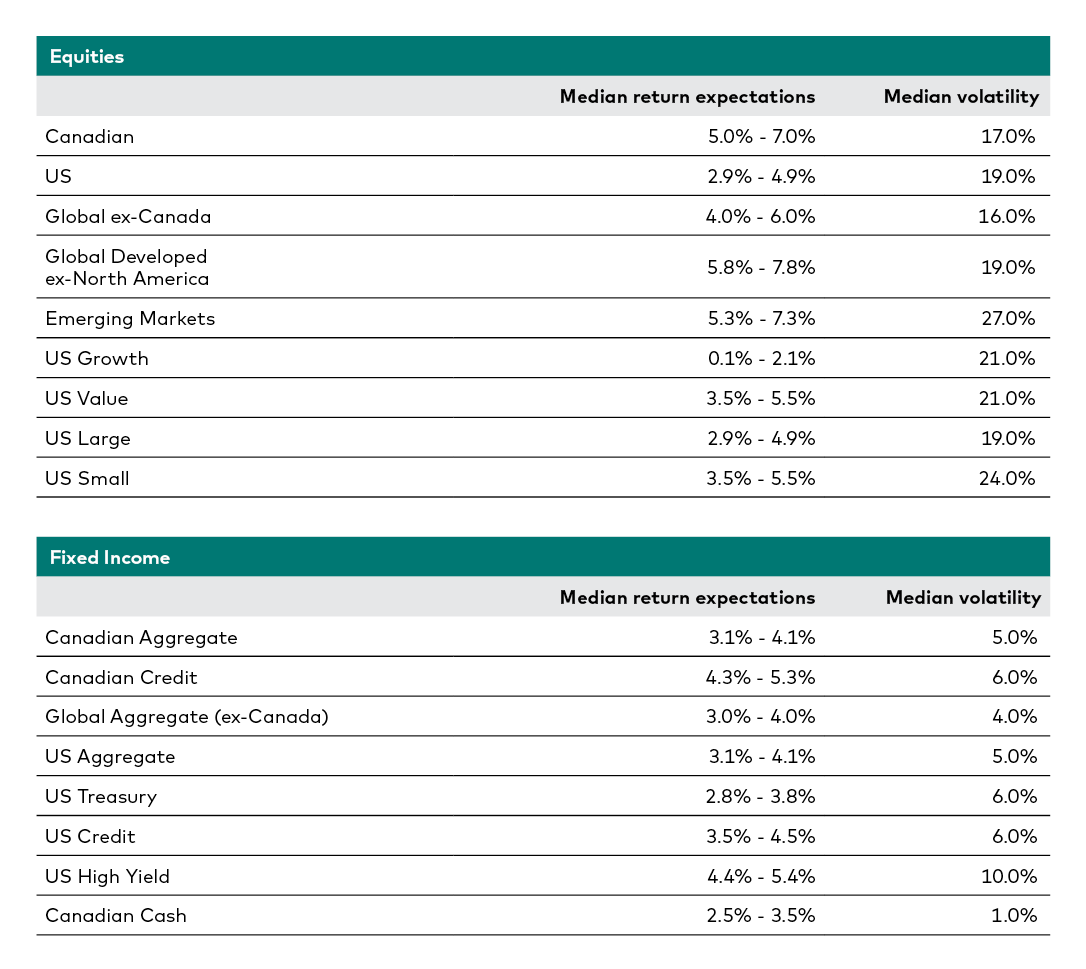

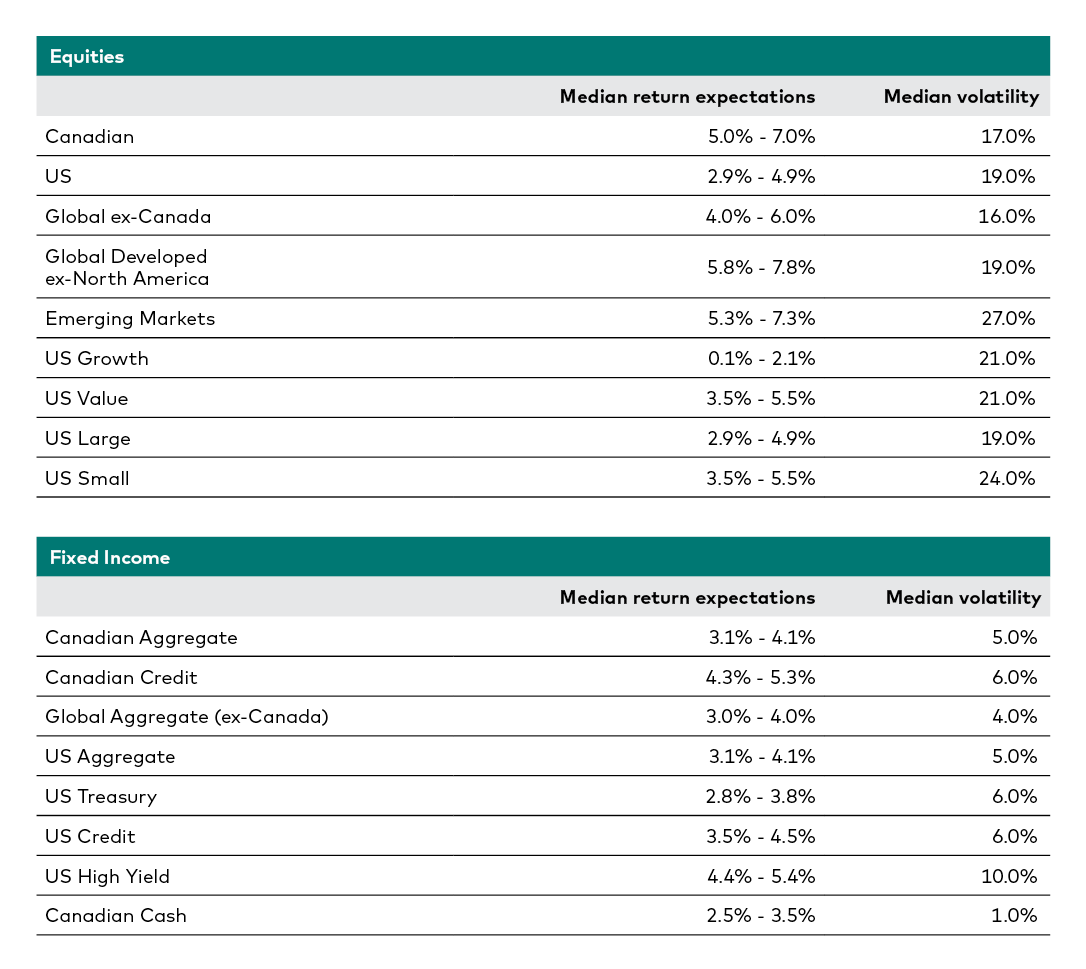

Future Expected Returns1

Canadian and Global Equities

Amid sizeable increases in equity valuations driven by an overall improvement in risk sentiment during Q4 of last year, Canadian and global equities rallied, driving down our 10-year return outlook for these two asset classes.

Our median 10-year returns expectations for Canadian equities at the end of December 2023 are in a range of 5.0% to 7.0%, about 0.3% lower than our September 2023 estimate. For global stocks (ex-Canada, unhedged), our forecasts have decreased by approximately 60 basis points to a 4.0% - 6.0% range, compared to September 2023.

Canadian and Global Bonds

At the end of December 2023, we anticipate that median 10-year returns for Canadian bonds will range from 3.1% to 4.1%, approximately 100 bps basis points lower than our forecast at the end of September 2023.

Likewise, for global aggregate bonds (ex-Canada, hedged), we now anticipate median 10-year returns of 3- 4%, also approximately 100 basis points lower than our 2023 September-end estimate.

The bond return estimates were impacted by declining bond yields across the board and expectations that central banks had reached their terminal rates.

1 All returns are in Canadian dollars, annualized median expected returns over the next 10 years and at the end of December 2023 using Vanguard Capital

Markets Model.

Publication date: April 2024

The information contained in this material may be subject to change without notice and may not represent the views and/or opinions of Vanguard Investments Canada Inc.

Certain statements contained in this material may be considered "forward-looking information" which may be material, involve risks, uncertainties or other assumptions and there is no guarantee that actual results will not differ significantly from those expressed in or implied by these statements. Factors include, but are not limited to, general global financial market conditions, interest and foreign exchange rates, economic and political factors, competition, legal or regulatory changes and catastrophic events. Any predictions, projections, estimates or forecasts should be construed as general investment or market information and no representation is being made that any investor will, or is likely to, achieve returns similar to those mentioned herein.

While the information contained in this material has been compiled from proprietary and non-proprietary sources believed to be reliable, no representation or warranty, express or implied, is made by The Vanguard Group, Inc., its subsidiaries or affiliates, or any other person (collectively, "The Vanguard Group") as to its accuracy, completeness, timeliness or reliability. The Vanguard Group takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this material.

This material is not a recommendation, offer or solicitation to buy or sell any security, including any security of any investment fund or any other financial instrument. The information contained in this material is not investment advice and is not tailored to the needs or circumstances of any investor, nor does the information constitute business, financial, tax, legal, regulatory, accounting or any other advice.

The information contained in this material may not be specific to the context of the Canadian capital markets and may contain data and analysis specific to non-Canadian markets and products.

The information contained in this material is for informational purposes only and should not be used as the basis of any investment recommendation. Investors should consult a financial, tax and/or other professional advisor for information applicable to their specific situation.

In this material, references to "Vanguard" are provided for convenience only and may refer to, where applicable, only The Vanguard Group, Inc., and/or may include its subsidiaries or affiliates, including Vanguard Investments Canada Inc.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.