The Canadian economy remains under pressure amid trade tensions and a softer labour market. GDP surprisingly rose by 2.2% in the first quarter of 2025 due to tariff frontrunning from U.S. firms. However, Canada’s outlook is increasingly uncertain pending the status of U.S. trade negotiations. We remain optimistic on imminent progress in these negotiations and with domestic momentum appearing to stabilize, we view risks to the Canadian economy as turning more favorable.

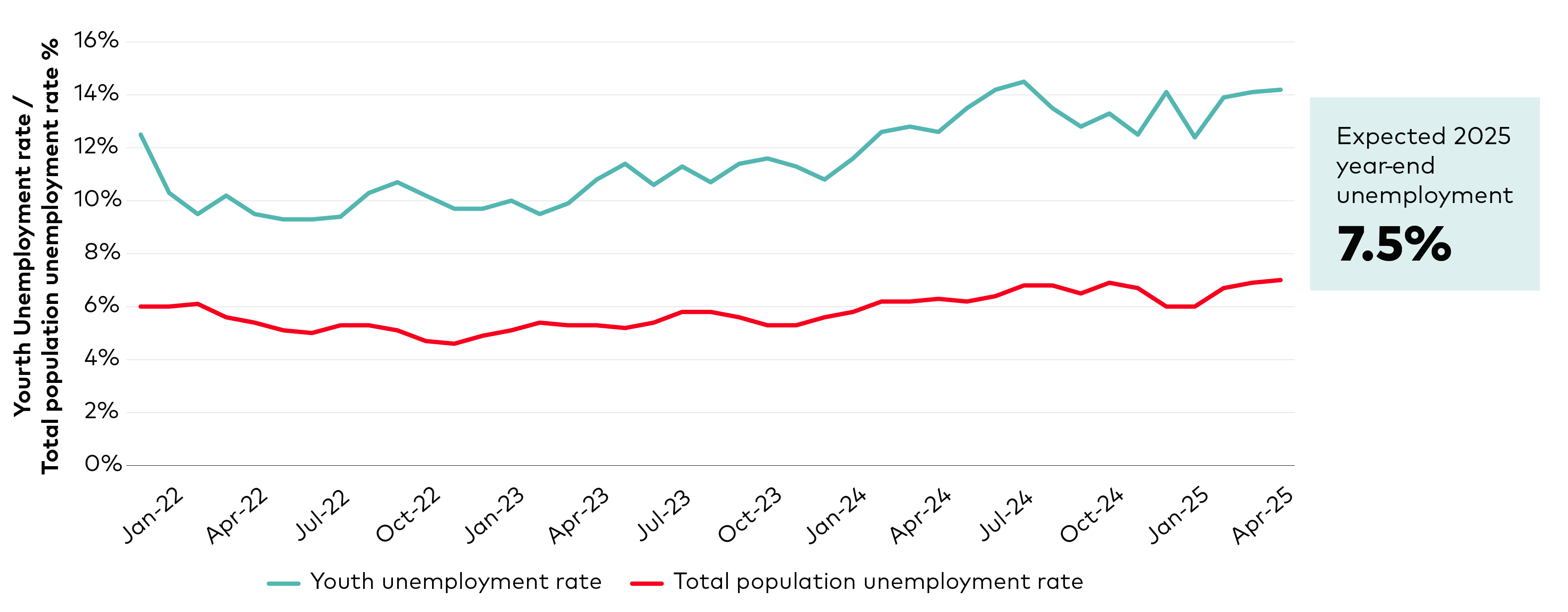

Canada’s unemployment rate rose to 7% in May and we anticipate this rising to 7.5% by year-end. Consumer and business sentiment has recovered since Liberation Day on April 2, but we expect trade uncertainty will impair business investment and household consumption going forward. Despite starting the year with a 1.7% GDP forecast for 2025, we now expect growth of just 1.25%, with equal balance to upside and downside risks.

The Bank of Canada (BoC) held its policy rate at 2.75% at its June meeting, citing persistent uncertainty around U.S. trade policy and the mixed economic signals at home, including firmer-than-expected core inflation and a higher unemployment rate. Given this uncertainty, we anticipate that the BoC will resume easing later this year, cutting the overnight rate to 2.25% by the end of the year. Slowing population growth will also negatively impact growth.

On a positive note, Canada now has the lowest U.S. tariff rate of any major trading partners. CUSMA exemptions resulted in most Canadian goods crossing the U.S. border tariff-free in April. The U.S. and Canada are expected to finalize a trade agreement in coming months, the outcome of which will materially weigh on our outlook. The digital services tax (DST), which was recently dropped by Canada in order to resume negotiations for a deal with the U.S, eased tensions and increased the likelihood of progress on trade negotiations.

Monetary Policy

The BoC held its policy rate at 2.75% at its last two meetings in April and June after seven consecutive cuts. We expect the central bank to cut rates twice this year and not go below the lower end of its policy rate for a few reasons. First, the BoC has clearly stated that it is more focused on current inflation than on economic weakness. Second, expansionary fiscal policy, which includes spending on major infrastructure projects, increased defence spending and a focus on increasing housing supply, likely puts a floor on how low the policy rate can go. Third, monetary policy has a widespread impact on the economy and is not an effective targeted mitigation for industries most impacted by tariffs.

The BoC has pointed to “unusual uncertainty” in the economy and mentioned that conflicting data, particularly on core inflation measures, led to the governing council proceeding carefully. We expect the policy rate to end the year at 2.25% given labour market strains, a weak housing sector, soft final domestic demand, and downward pressure on core inflation. Also, slowing population growth coupled with increased economic slack reduces Canada’s potential growth and will decrease the neutral rate. Thus, a 2.25% policy rate will be more restrictive relative to the time prior to the imposition of tariffs. Finally, cuts to interest rates may help stimulate the economy sooner than many of the Federal government’s other targeted fiscal initiatives including Bill C5, the One Canadian Economy Act that aims to remove interprovincial trade barriers, fast-track major projects and increase labour mobility.

Inflation

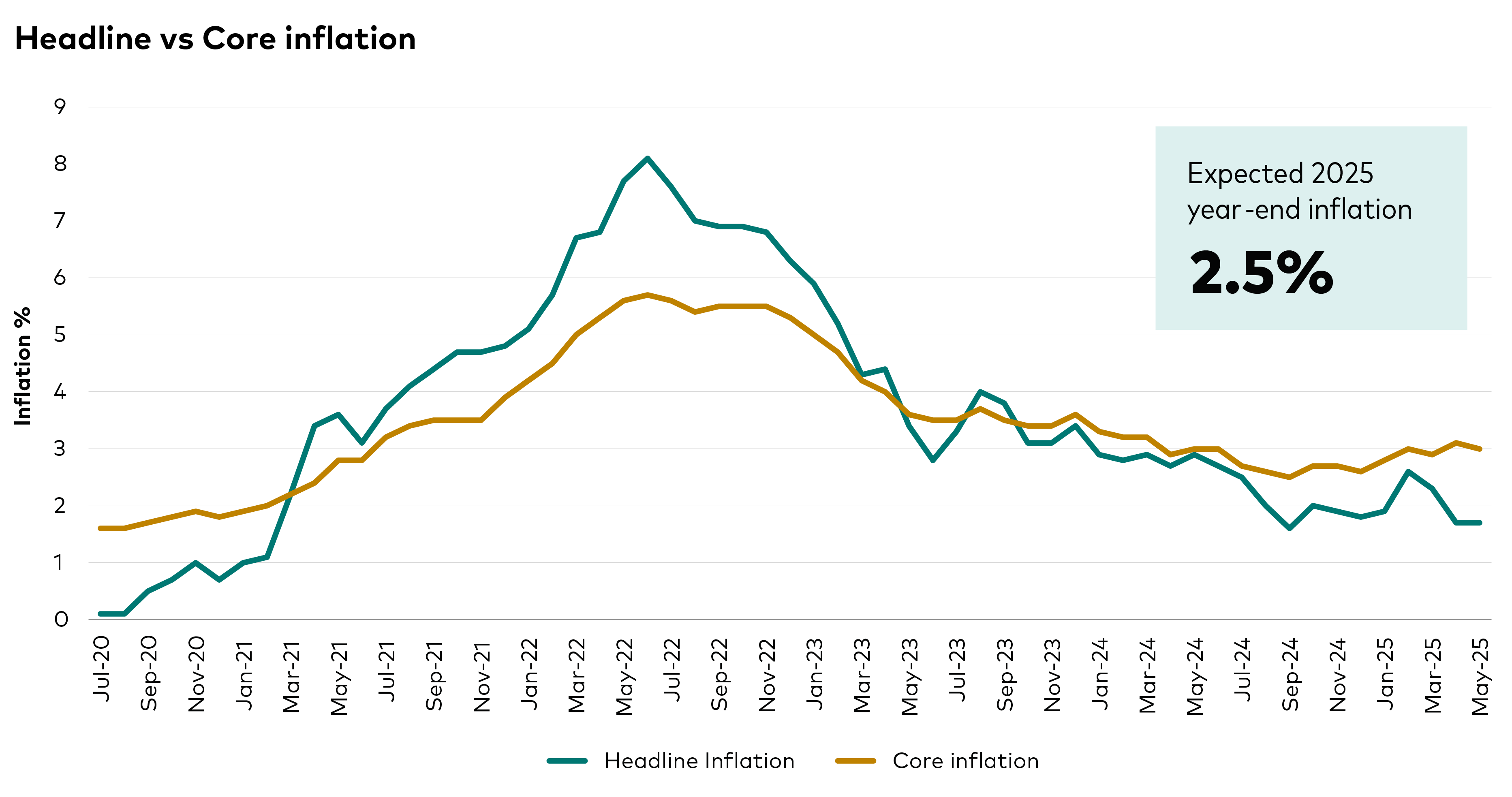

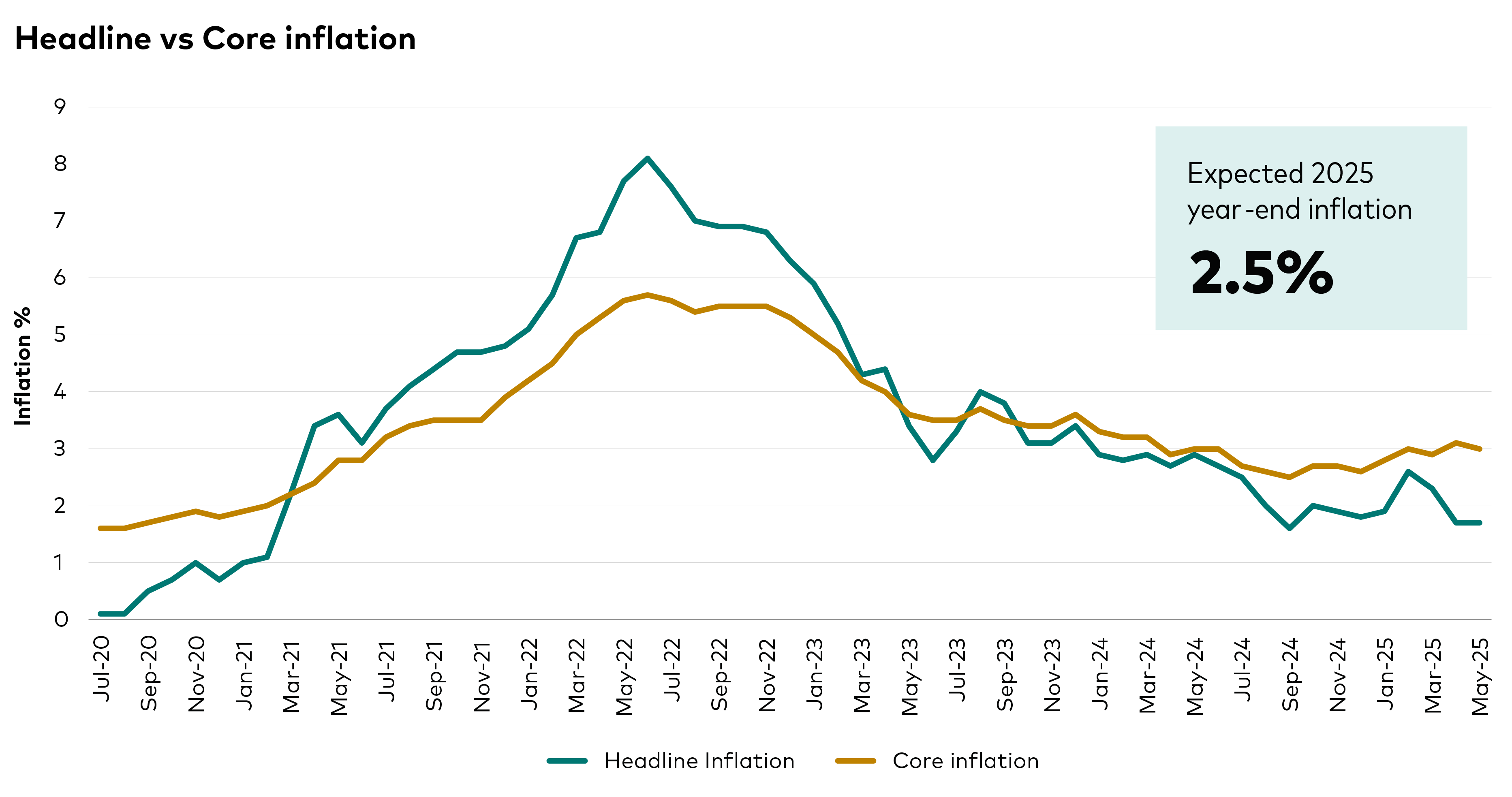

May inflation numbers had a deceptively soft inflation rate of 1.7% for headline inflation and an elevated 3.0% rate for core inflation, both for median and trim measures1. Lower flash estimates for manufacturing sales indicating a drop of 1.3% are pointing to some signs that the Canadian economy is starting to feel the impact of U.S. tariffs.

The low headline inflation number was deceptive because it had been pushed down by both the GST holiday which ended in mid-February and the consumer carbon tax which was removed in April. The BoC’s core measures were also influenced by disruptions that Tiff Macklem, governor of the BoC, categorizes as creating “unusual volatility.” Core inflation was likely pushed higher due to lagged effects from a weaker Canadian dollar which put upward pressure on the cost of U.S. imports.

Core inflation is above the BoC's target range

Source: Bank of Canada

We expect aggregate demand to slow due to several factors including a rise in unemployment and stalled population growth resulting in slowing economic activity that should keep inflation within the BoC’s target range of 1.0% - 3.0%. We expect year-end inflation to be 2.5%. Elevated mortgage rates, relative to pre-pandemic lows, implies that Canadians have less discretionary income. Additionally, continued uncertainty around U.S. trade policy has put downward pressure on inflation as businesses hold back on hiring, spending and investing. Consumers are also holding back on purchases, particularly big-ticket items.

Inflation numbers for food, travel services and healthcare were still elevated in May. Shelter inflation, which has an almost 30% weight in the CPI, is still elevated, contributing to over 50% to the rate of inflation. This is despite the fact that rents are falling amid slowing population growth and declining mortgage interest costs.

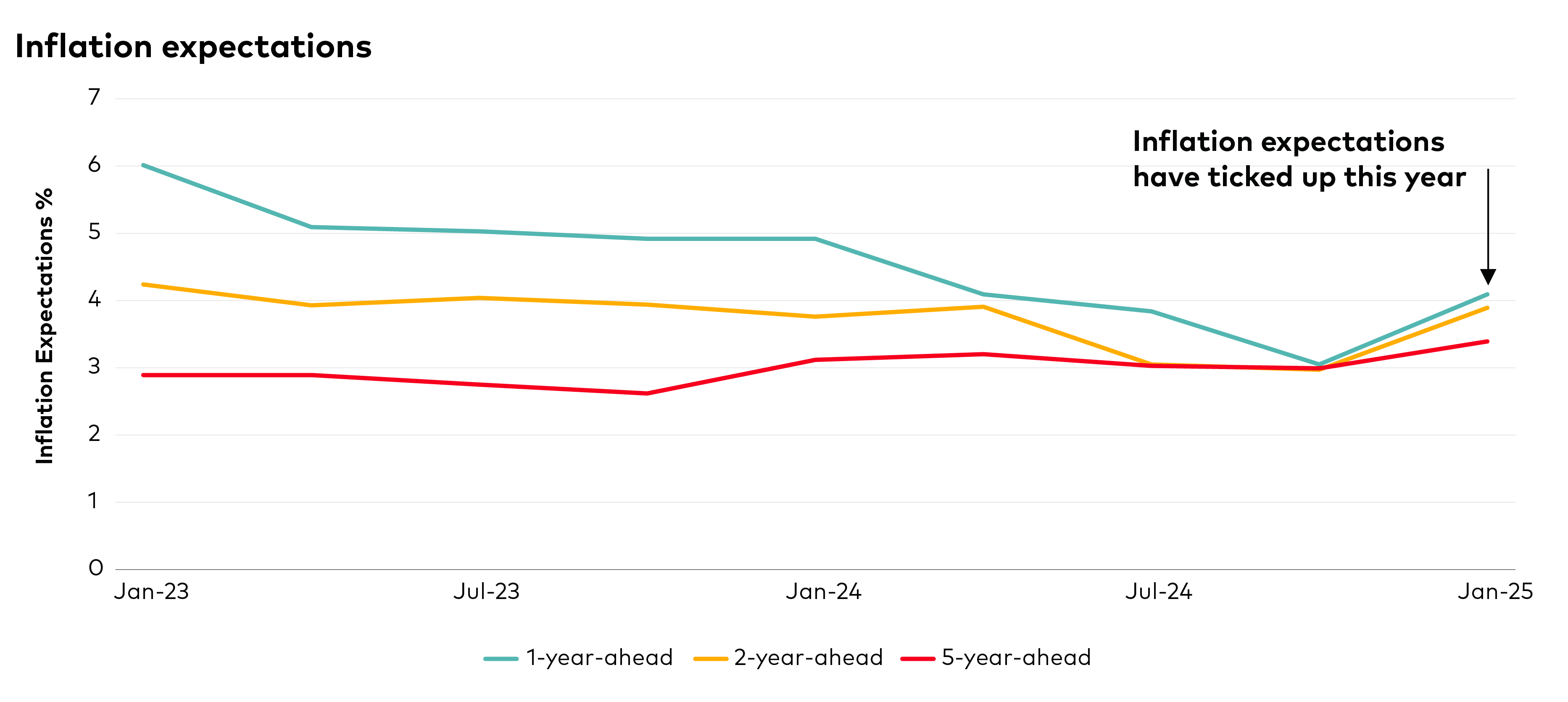

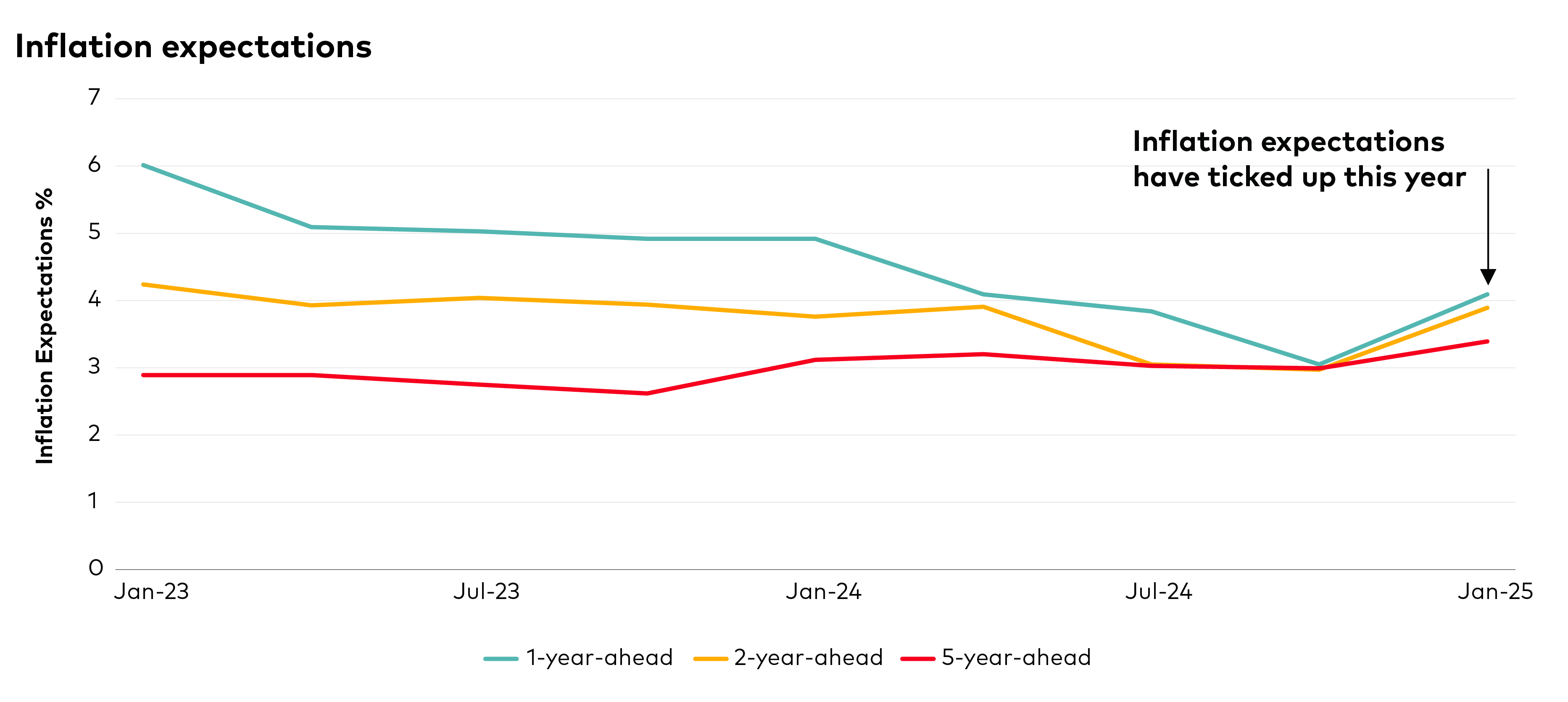

The BoC is particularly concerned with inflation anchoring which can create a wage-price spiral as workers will demand higher wages if they have higher expectations for inflation. High inflation expectations also increase uncertainty as it’s more difficult to ascertain the actual rate of inflation. Inflation pass-through rates also rise in this scenario as businesses are more receptive to increase inflation if consumers expect it. As we see from the chart below, inflation expectations have ticked up this year although the 5-year-ahead remains well anchored.

Long-term inflation expectations remain anchored

Source: Canadian Survey of Consumer Expectations

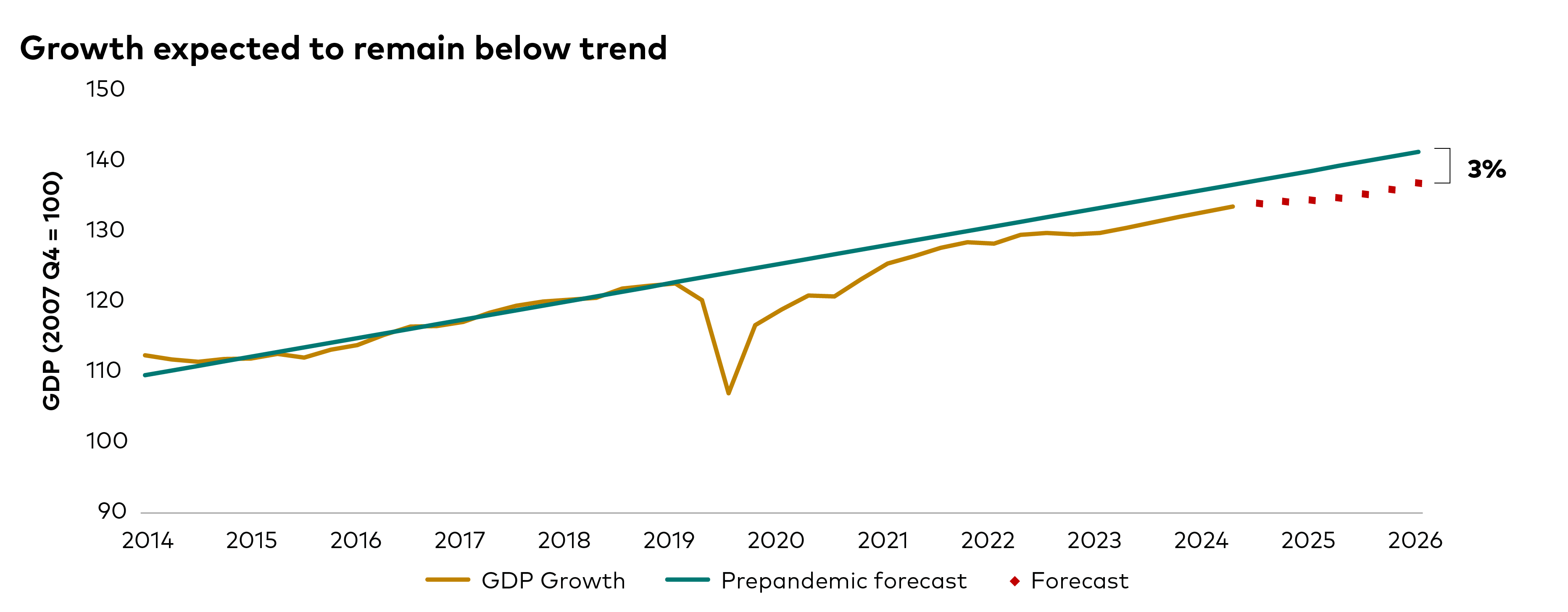

GDP Growth

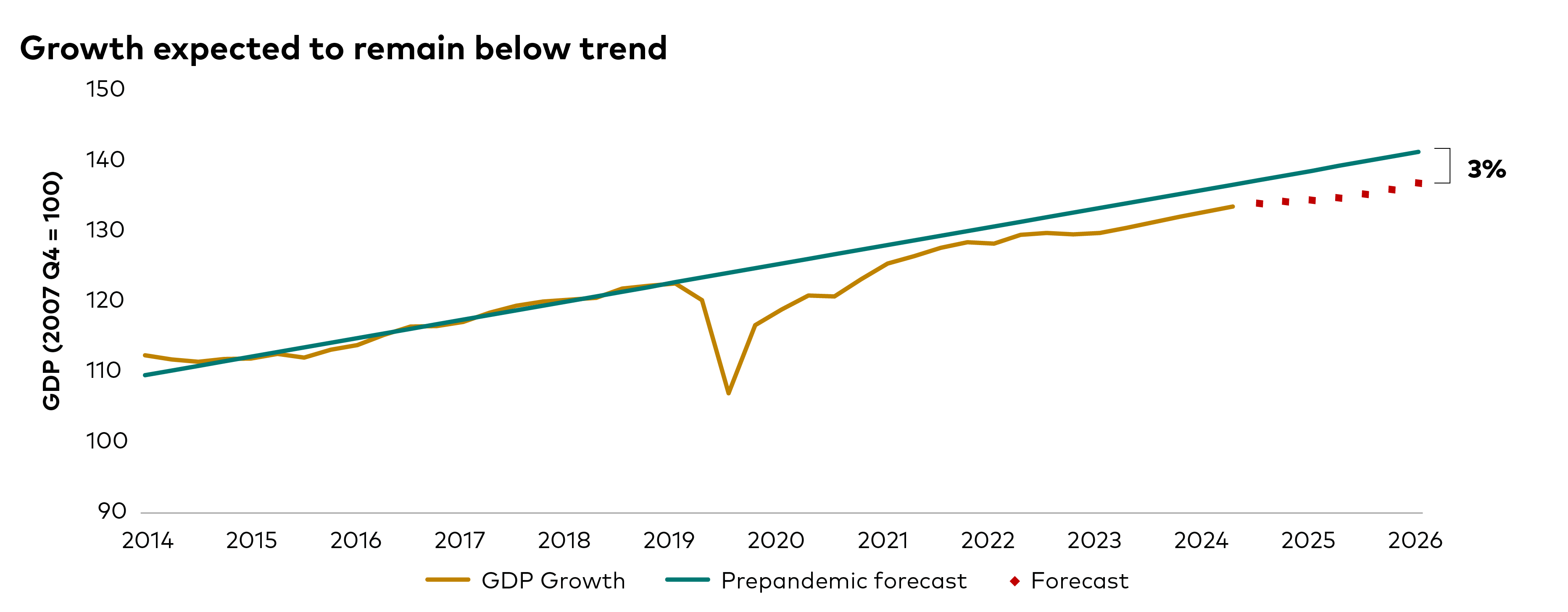

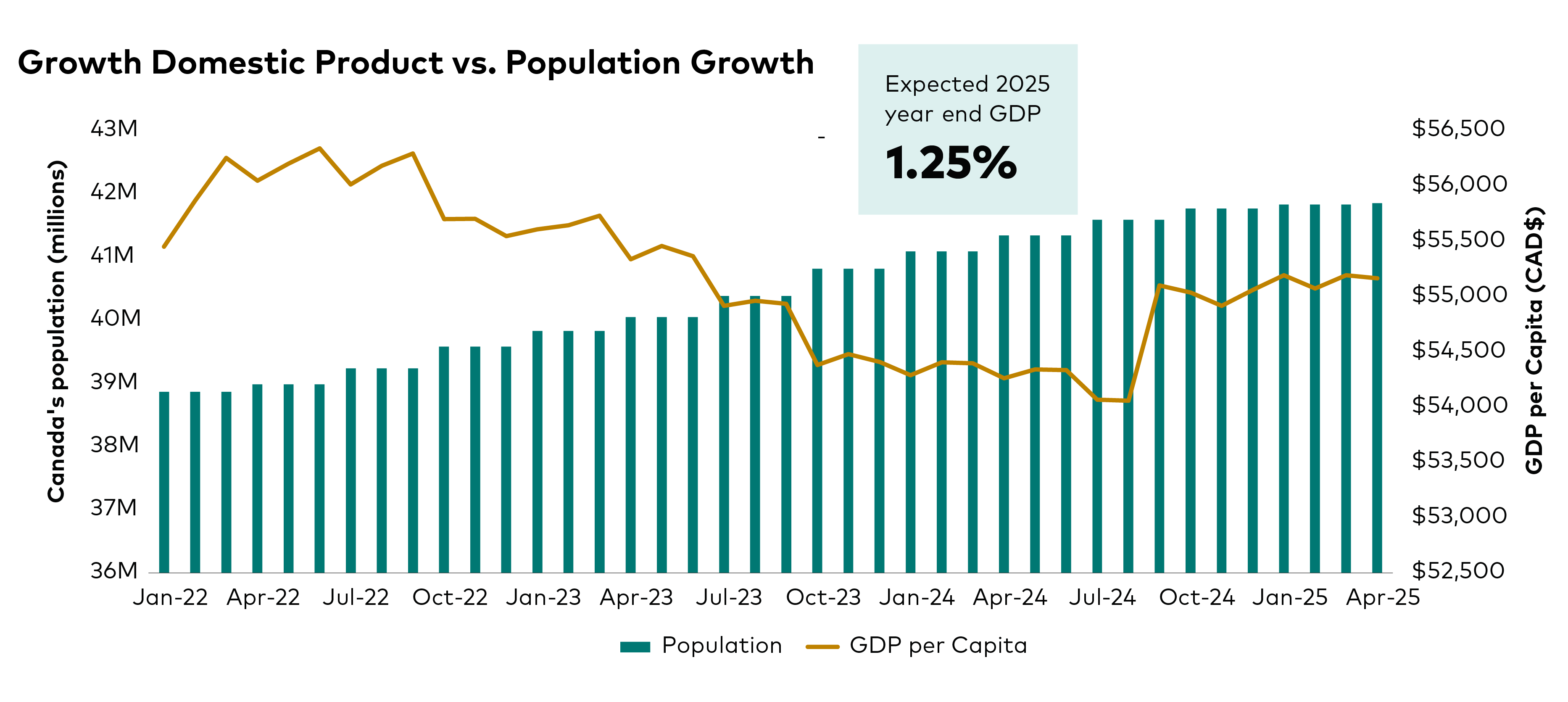

In Q1, 2025 GDP surprised to the upside with 2.2% growth largely due to tariff frontrunning from U.S. firms. Declines in wholesale trade and manufacturing resulted in GDP contracting by 0.1% in April as this frontrunning dissipated, but we remain optimistic about an imminent improvement in US-Canada trade negotiations while recent indicators suggest that domestic momentum may be stabilizing. Nominal wage growth remains supportive, and unemployment increases are concentrated among younger workers, who account for a relatively small share of overall consumption. We expect 2025 GDP growth of 1.25% but our near-term outlook remains highly dependent on US-Canada trade negotiations, of which we remain optimistic. With one of the lowest effective tariff rates among major US trading partners, prolonged negotiations between US and other nations may support Canadian exports in the near-term. Slowing population growth has also reduced potential GDP while easing monetary policy has provide relief to household as household debt-to-income in Canada fell to 171.1% in Q1 2025, the lowest rate since Q1, 2021.

Source: Vanguard Research

Longer term, we see some positive news for Canada’s potential GDP as the Federal and Provincial governments make progress on reducing interprovincial trade barriers. Ottawa removed 53 federal exemptions from Canada’s free trade agreement that inhibited interprovincial trade on provincial carve outs, most relating to federal procurement rules. Additionally, some provinces have been negotiating with each other to remove trade barriers. Issues such as regulatory differences between provinces, geographic restrictions on goods and impediments to labour mobility have negatively impacted Canada’s productivity and GDP per capita.

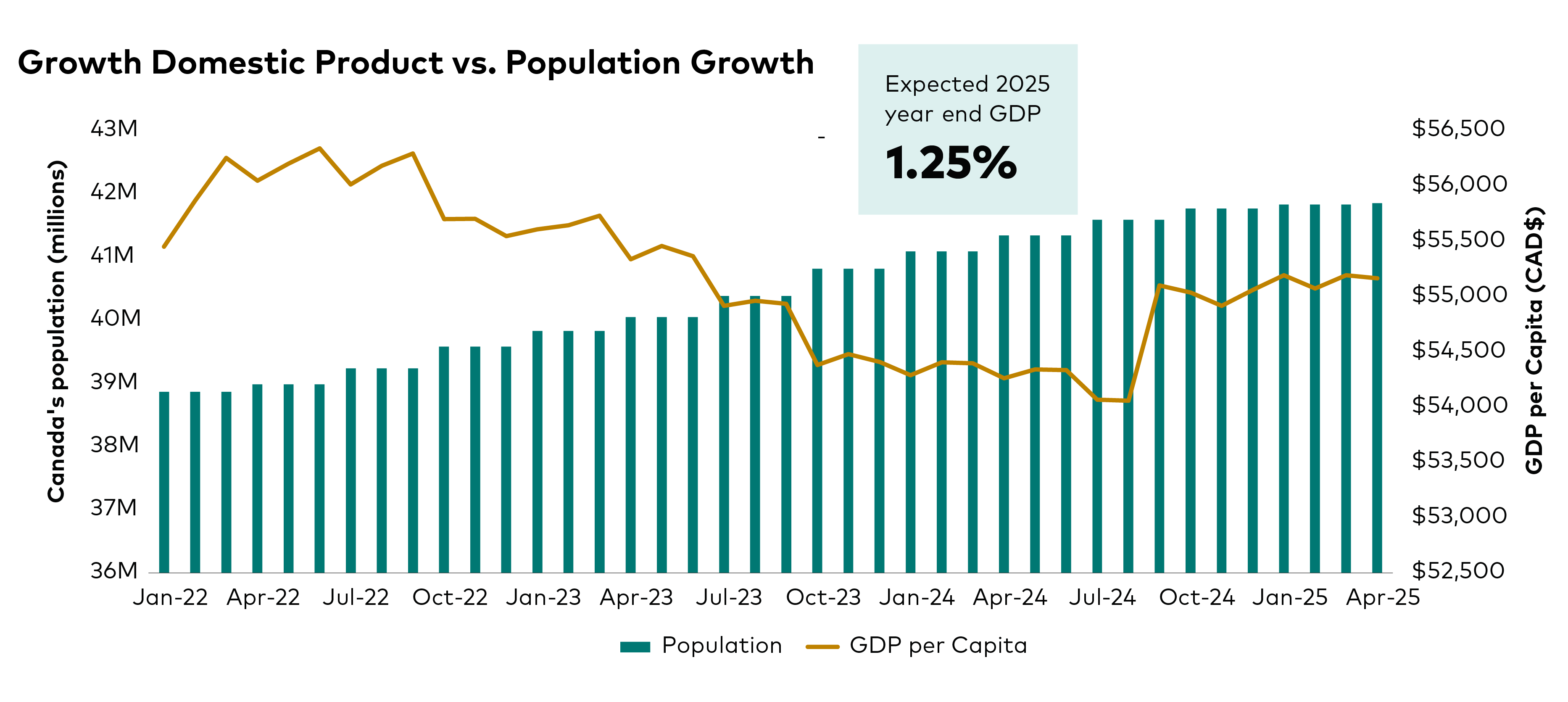

It's too early to assess the impact of these measures and those outlined in Bill C5. We have recently seen an increase in Canada’s GDP per Capita as the chart below shows. Slowing population growth for six consecutive quarters along with strong GDP numbers for Q4 2024 and Q1 2025 have boosted Canada’s GDP per capita.

GDP per Capita has risen recently as population growth has slowed

Source: Statistics Canada

Labour Markets

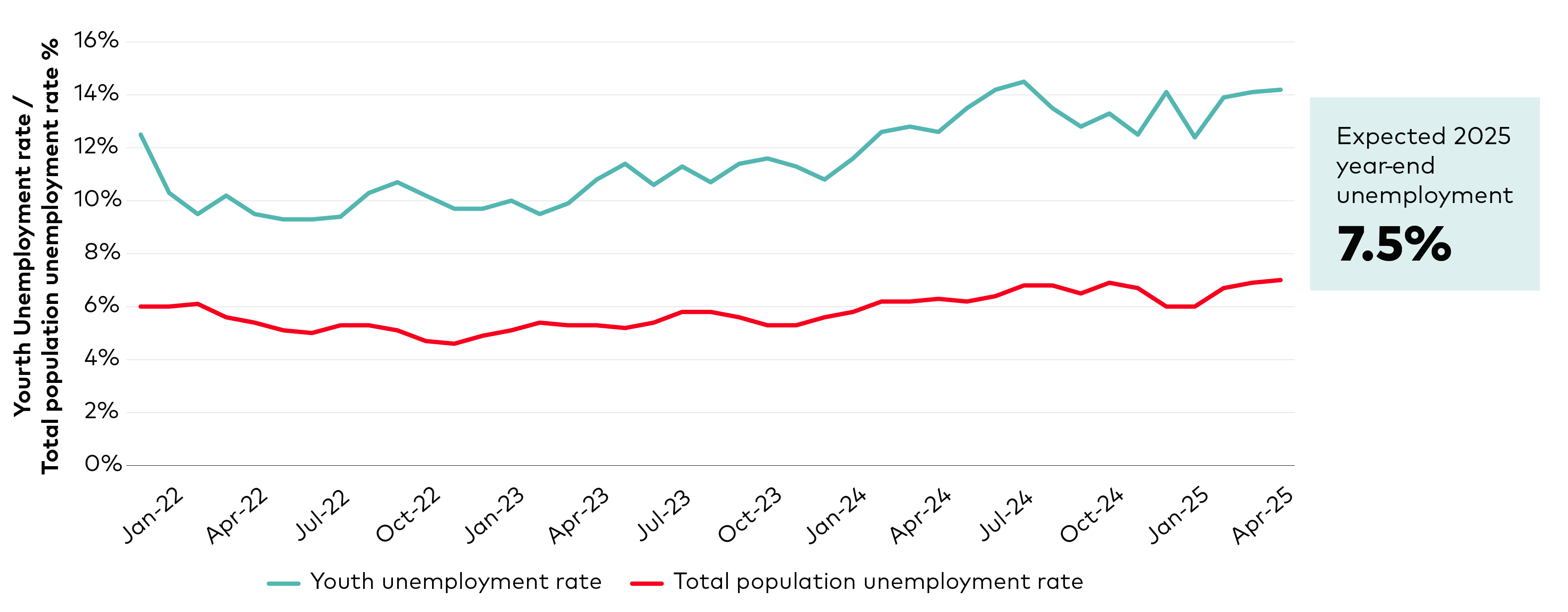

Canada’s labour supply has slowed, predominantly due to caps on temporary foreign workers and international students, but employment growth has slowed even more. There has been "virtually no employment growth" since January after strong gains in the fall.

The country’s unemployment rate is now its highest in nine years, outside of the pandemic. There are three people unemployed for every vacancy and the average duration of unemployment has risen to 22 weeks, up from 18 weeks a year ago.

The labour market is a tale of two cities.

The first city is comprised of gainfully employed workers who have been part of the workforce for a while. They are doing reasonably well despite an unemployment rate of 7% as layoffs have not risen. Quits levels are low and the ones impacted negatively are those concentrated in trade-related sectors. The worst hit is the manufacturing sector, which has now seen four consecutive months of job losses.

The other city is comprised on new entrants and those seeking to enter the labour force, particularly Canada’s youth. They have not had it easy as the youth unemployment rate is now 14.2% and the rate for returning students is even more elevated at over 20% (see Chart 5).

Given the sharp rise in uncertainty companies are less willing to hire new workers but at the same time not willing to lay off experienced workers. Trade development will play a crucial role in the labour markets. We expect the unemployment rate will reach 7.5% by year-end.

The employment picture: early cracks in job market

Source: Statistics Canada